Operations in 2015

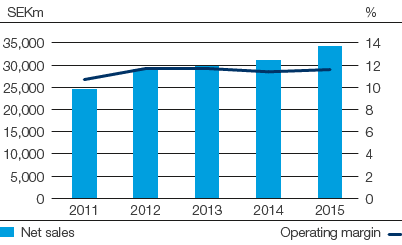

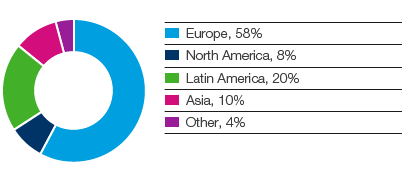

Net sales rose 11% to SEK 34,344m (31,066). Organic sales growth, which excludes exchange rate effects, acquisitions and divestments, was 7%, of which volume accounted for 4% and price/mix for 3%. Organic sales growth was 4% in mature markets and 12% in emerging markets. Emerging markets accounted for 43% of sales. Exchange rate effects increased sales by 4%.

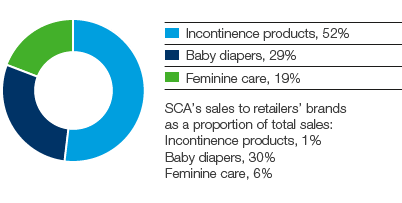

For incontinence products, under the globally leading TENA brand, organic sales growth was 4%. Growth is attributable to emerging markets and Western Europe, which compensated for lower sales in North America. For baby diapers, organic sales growth was 7%. Growth is mainly attributable to Europe. For feminine care products, organic sales growth was 18%, attributable to emerging markets and Western Europe.

Operating profit, excluding items affecting comparability, rose 13% (12% excluding currency translation effects) to SEK 3,990m (3,526). Profit was favorably affected by a better price/mix, higher volumes and cost savings. Higher raw material costs mainly resulting from the stronger US dollar had a negative earnings impact. Investments were made in increased marketing activities for incontinence products and in India.

The operating margin 1) was 11.6% (11.4).

Return on capital employed 1) was 29.2% (27.3).

The operating cash surplus amounted to SEK 5,018m (4,511). Operating cash flow increased to SEK 3,792m (3,345).

Capital expenditures amounted to SEK 1,743m (1,530).

Operating profit 1), SEKm:

3,990

Operating margin 1):

11.6%

Net sales and operating margin

Excluding items affecting comparability.

2012 and 2013 restated in accordance with IFRS 10 and 11.

SEKm |

2015 |

2014 |

||

|

||||

Net sales |

34,344 |

31,066 |

||

Operating cash surplus |

5,018 |

4,511 |

||

Change in working capital |

–314 |

–96 |

||

Current capital expenditures, net |

–840 |

–884 |

||

Other operating cash flow |

–72 |

–186 |

||

Operating cash flow |

3,792 |

3,345 |

||

Operating profit 1) |

3,990 |

3,526 |

||

Operating margin, % 1) |

12 |

11 |

||

Capital employed |

13,148 |

13,578 |

||

Return on capital employed, % 1) |

29 |

27 |

||

Strategic capital expenditures |

|

|

||

plant and equipment |

–903 |

–646 |

||

company acquisitions/divestments |

23 |

–567 |

||

Average number of employees |

12,688 |

12,988 |

||

No. of employees at Dec. 31 |

12,700 |

12,641 |

||

Operating profit and return on capital employed

Excluding items affecting comparability.

2012 and 2013 restated in accordance with IFRS 10 and 11.

TARGETS

- Return on capital employed of 30% over a business cycle

- Annual organic sales growth of 5–7%

SCA’s sales by product segment

Emerging markets accounted for

43%

of the business area’s sales in 2015 and reported organic sales growth of 12% for the year.

SCA’s sales by region

1) Excluding items affecting comparability.