SCA’s business

Consumer tissue

Offering and market position: SCA is the world’s second largest supplier of consumer tissue, which includes toilet paper, kitchen rolls, facial tissues, handkerchiefs and napkins. In Europe, SCA is the clear market leader and holds a market share that is about double that of the second largest player. SCA also holds strong positions in many emerging markets, such as Russia and Colombia, where the Group is the market leader, and in Mexico, where it holds the number two position. SCA holds the number three position in China through its majority shareholding in Vinda.

Products sold under SCA’s own brands account for about 64% of SCA’s sales, while the remaining 36% is sold under retailers’ brands. SCA’s brand portfolio comprises several strong regional brands. Tempo, Zewa and Lotus are leading brands in large areas of Europe, while Cushelle, Velvet and Plenty are strong brands in the UK and Ireland, and Edet in the Nordic region and the Netherlands. In Hong Kong and Morocco, Tempo is the clear market leader in handkerchiefs. In South America, SCA markets products under the Familia and Favorita brands, and holds strong positions in emerging markets including Colombia, Chile and Ecuador. In the Mexican market, SCA occupies a strong position with the Regio brand. Vinda is one of the leading brands in China.

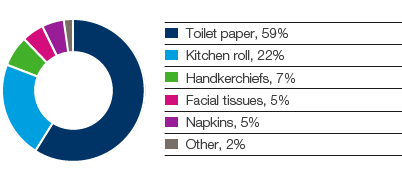

Product breakdown for consumer tissue, European market

Strategy: In the markets where SCA has a presence, the strategy is to be the leading supplier of strong and innovative brands through successful brand marketing and accelerated innovation. SCA will continue to focus on increasing efficiency in the supply chain and innovations that drive product mix improvements. In Europe, the aim is to further strengthen SCA’s leading market position and to grow key positions for SCA’s own consumer tissue brands and the branded sales share, while aiming to be the best retailer-branded supplier. To improve efficiency and continue to build on SCA’s strong regional brands, SCA works with a global brand platform for consumer tissue.

AfH tissue

In 2015, the new Tork Image DesignTM dispenser range was launched.

Offering and market position: SCA is the world’s largest supplier of AfH tissue with the global Tork brand. The AfH segment comprises institutions and companies, including hospitals, healthcare institutions, large workplaces, industries, restaurants and hotels, for which SCA develops and sells complete hygiene solutions comprising tissue, soap, hand lotion, hand sanitizers, dispensers, cleaning and wiping products, service and maintenance. The products are distributed by distributors and service companies.

SCA is the clear market leader in Europe and holds a market share that is about double that of the second largest player. Following the acquisition of Wausau Paper Corp., which was completed on January 21, 2016, SCA is the second largest player in North America. SCA’s market position is particularly strong in the foodservice segment in North America, where approximately every second napkin is supplied by SCA. SCA also holds strong positions in emerging markets, such as Russia and Colombia, where SCA is the market leader.

The global brand Tork provides significant synergies since the difference in consumer and customer requirements is minimal in regard to tissue and dispensers in the various parts of the world.

Strategy: SCA aims to strengthen its position as global market leader and to accelerate profitable growth. The ambition is to globally continue to focus on increasing sales of soap, hand lotion, hand sanitizers, dispensers and products for wiping and cleaning tasks as part of the tissue offering. Strong innovations and product launches are key to improving the customer offering, accelerating profitable growth and increasing the Tork brand awareness. In North America, where SCA already occupies a strong position in the foodservice segment, the company aims to strengthen its washroom offering and to increase its share of premium sales and services.

Acquisition of Wausau Paper Corp.

In October 2015, SCA announced that it had made a public bid for Wausau Paper for a total consideration USD 513m in cash. Wausau Paper is one of the largest manufacturers of AfH tissue in North America. The company manufactures and markets AfH towel and tissue products and markets soap and dispensing systems. The acquisition of Wausau Paper is an excellent strategic fit and strengthens SCA’s presence in North America. The Wausau Paper product portfolio complements SCA’s offering in North America and provides SCA with access to premium tissue in the region. The combined operations will provide customers with access to a comprehensive portfolio of foodservice offerings, premium tissue as well as washroom products. The acquisition is expected to generate annual synergies of approximately USD 40m, with full effect three years after closing. The restructuring costs are expected to amount to approximately USD 50m. The transaction was completed on January 21, 2016.