Profitable growth

Strategic priority

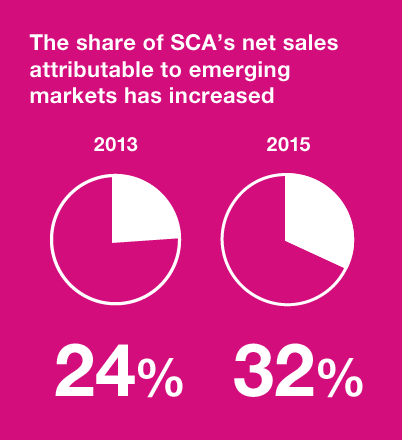

To achieve profitable growth, SCA works to grow profitable market positions, improve or exit under-performing positions, broaden its offering of product categories and expand integrated solutions and services. In the digital segment, SCA is investing in digital products and services as well as increasing online sales. SCA is well-positioned to leverage the growth potential existing in both mature and emerging markets. SCA’s long-term goal is to be a leader and strengthen its brand positions in the markets that it serves. SCA’s ambition is to increase the emerging markets’ share of sales and profit. In addition to organic sales growth, SCA sees a potential to also grow through acquisitions. Increasing the hygiene business’s share of the SCA Group has been a strategic step toward reducing the company’s sensitivity to economic fluctuations and thereby ensuring a more long-term stable level of profitability and growth.

New production plant in Brazil

In 2015, SCA decided to invest approximately SEK 650m in a new production plant for incontinence products in Brazil. The investment will increase SCA’s production capacity and improve SCA’s profitability for incontinence products in Brazil in the long term. Brazil is the third largest retail market in the world for incontinence products and SCA is now the second largest company in the country with its global leading brand TENA and the local brand Biofral.

Investment in increased pulp capacity

To satisfy the growing demand for pulp, SCA decided in 2015 to invest in increased capacity for pulp production at Östrand pulp mill in Sweden. Over time, the investment will increase sales and competitiveness and create a world-class cost position and higher margins. The investment will amount to about SEK 7.8bn over a three-year period. Production is expected to commence in 2018.

North American Away-from-Home tissue acquisition

In 2015, SCA made a public bid on Wausau Paper Corp., one of the largest AfH tissue companies in the North American market. The acquisition of Wausau Paper is an excellent strategic fit for SCA and strengthens SCA’s presence in North America. The Wausau Paper product portfolio complements SCA’s offering in North America and gives SCA access to premium tissue in the region. The acquisition is expected to generate annual synergies of approximately USD 40m, with full effect three years after closing. The restructuring costs are expected to amount to approximately USD 50m. The transaction was completed on January 21, 2016.

Strengthened cooperation with Vinda in Asia

Asia is an important growth market for SCA with a large population and low penetration of hygiene products. In 2015, SCA decided to divest its business in Southeast Asia, Taiwan and South Korea for integration with Vinda. Since 2013, SCA has been the majority shareholder in Vinda, one of China’s largest hygiene companies. This transaction strengthens the collaboration between SCA and Vinda and enables us to further leverage the companies’ joint strengths to build a leading Asian hygiene business.

Addressed areas with weak profitability

In 2015, SCA addressed areas where the Group has weak profitability and weak market positions. Last year, SCA exited the baby diaper markets in Brazil and South Africa and changed to an export business for baby diapers in Thailand.

Outcome 2015

Net sales rose 11% to SEK 115,316m (104,054). Organic sales growth, which excludes exchange rate effects, acquisitions and divestments, was 5%, of which volume accounted for 3% and price/mix for 2%. Organic sales growth was 2% in mature markets and 11% in emerging markets. Emerging markets accounted for 32% of sales.

Operating profit, excluding items affecting comparability, rose by 10% to SEK 13,014m (11,849).

SCA provided training for 33,000 nurses worldwide in incontinence and skincare in 2015.