SCA’s business

Incontinence products

Offering and market position: SCA offers a broad range of incontinence products under the TENA brand and is the clear global market leader. SCA’s offering, which includes both products and services, improves the quality of life for consumers while also reducing costs for institutional customers, such as nursing homes. SCA’s offering also includes an assortment of skincare products, wash gloves and shower caps. Through TENA Solutions, SCA helps nursing homes provide the best care by offering procedures, analysis tools and training. The advantages include improved well-being for the care recipients, a better workplace environment, less resource consumption and lower overall costs.

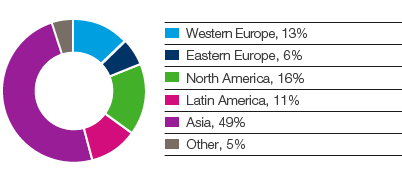

SCA’s global market share in incontinence products is more than double that of the second largest player. SCA is the market leader in Europe, Asia (excluding Japan) and Latin America.

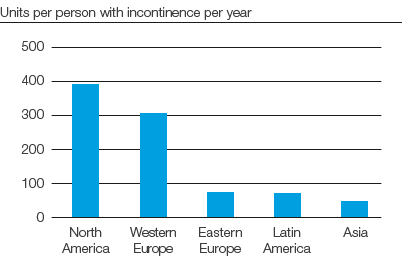

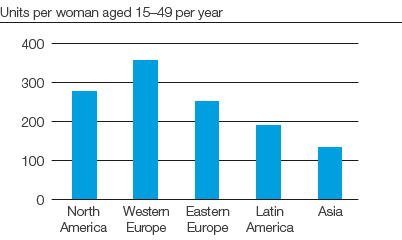

Use of incontinence products

Data is based on market data and SCA’s estimates.

Strategy: SCA aims to strengthen and develop its global market-leading position and set the standard in the market for incontinence care. Since incontinence is surrounded by social taboos in many regions of the world, it is vital to raise understanding and acceptance of the condition to enhance the quality of life for people suffering from incontinence. SCA is involved in increasing awareness of incontinence as a disease and contributing to better conditions for people who suffer from it by arranging seminars and educational programs for nurses and professional caregivers within the scope of the health and medical care systems in various countries. To help to establish sustainable reimbursement systems, SCA works with decision-makers and governments in different countries. SCA works actively to break the taboos surrounding incontinence and continues to invest in order to increase its market penetration by providing information and through marketing activities, training and global forums. SCA’s activities for the retail trade include information, advertising and the development of increasingly discreet, comfortable, easy-to-use and effective products, always with the customer and consumer benefits in mind. With the introduction of TENA Men and lights by TENA, SCA is further expanding its offering for men and consumers with lighter incontinence problems. For institutional customers, SCA will continue to promote TENA Solutions to help customers improve the quality of their incontinence care and lower their overall costs.

Investment in new production facility in Brazil

Through an acquisition made in 2011, SCA established a presence in the Brazilian market for incontinence products. Since then, SCA has increased its sales and market share in Brazil. SCA is now the second largest company in the Brazilian market for incontinence products, with its global leading brand TENA and the local brand Biofral. Brazil, which is one of SCA’s prioritized emerging markets, is the third largest retail market in the world for incontinence products. In 2015, SCA decided to invest approximately SEK 650m in a new production facility in Brazil for the manufacture of incontinence products. The new production facility will replace the smaller existing plant and production is scheduled to commence in 2016. The investment will increase SCA’s production capacity and improve SCA’s profitability in Brazil in the long term. It will also enable SCA to capitalize on the growth opportunities in the Brazilian market for incontinence products and to potentially launch other product categories in the future.

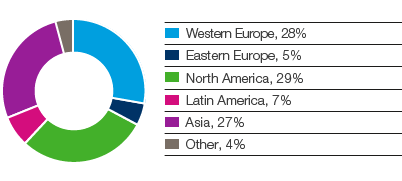

Incontinence products –

global market

Incontinence products –

sales channels, global market

Baby diapers

Offering and market position: SCA offers both open baby diapers and pant diapers, as well as baby-care products such as wet wipes, shampoo, lotion and baby oil, and is the world’s fourth largest player in the segment and the second largest in Europe. In Europe, SCA markets baby diapers under its own Libero brand and under retailers’ brands. SCA’s strongest market is the Nordic region, where the Libero brand is the market leader. Examples of other strong regional brands are Drypers in Southeast Asia and Pequeñin in South America.

Strategy: SCA works to strengthen the positions of its own brands in both mature and emerging markets and to improve the profitability in the baby diapers segment. As part of SCA’s work to improve profitability, several actions were taken during 2015 to address weak market positions with unsatisfactory profitability. As a result, SCA has divested the baby diapers operation in South Africa, exited the baby diapers market in Brazil and changed to an export business for baby diapers in Thailand. Innovations are important to have a strong branded and retail-branded product offering.

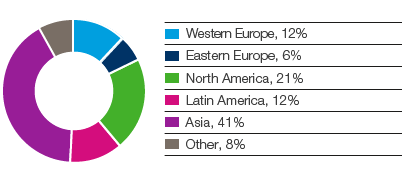

Baby diapers – global market

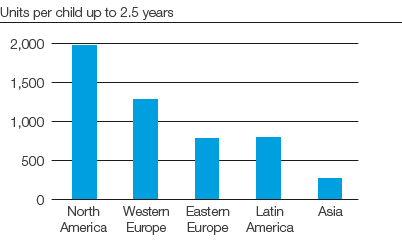

Use of baby diapers

Data is based on market data and SCA’s estimates.

Feminine care

Offering and market position: In feminine care, SCA offers a broad product portfolio that includes pads, panty liners, tampons, intimate soaps and intimate wipes. SCA is the world’s fifth largest player in the segment and the third largest in Europe. SCA is the market leader in Latin America.

A large and growing share of SCA’s sales takes place in emerging markets such as Latin America, Russia, Eastern Europe, the Middle East and Asia. Examples of regional brands supported by SCA’s global brand platform include Libresse in the Nordic region, Russia and Malaysia, Bodyform in the UK, Nana in France, the Middle East and North Africa, and Saba and Nosotras in Latin America.

Strategy: SCA’s strategy is to be the fastest growing feminine care brand globally and to increase sales while maintaining good profitability. SCA views it as an important task to promote awareness of hygiene and menstruation. School programs are being carried out in Latin America, Asia and Europe that aim to educate girls about what happens to their bodies during puberty and when they have their period.

Feminine care – global market

Use of feminine care products

Data is based on market data and SCA’s estimates.