E4. Financial liabilities

AP Accounting principles

The main principle for recognition of SCA’s financial liabilities is that they are initially measured at fair value, net after transaction costs, and subsequently at amortized cost according to the effective interest method. Transaction costs are recognized on a straight-line basis over the term of the loan.

In cases where loans with fixed interest rates are hedged using derivatives, both the loan and the derivative are measured at fair value through a fair value hedge. Non-current loans that are subject to hedge accounting are discounted to the market interest rate without a credit spread. The cash flows from the interest rate derivative is discounted to the same market interest rate as the loan and the changes in value are recognized in income statement.

SEKm |

2015 |

2014 |

2013 |

||||

|

|||||||

Current financial liabilities |

|

|

|

||||

Amortization within one year |

471 |

497 |

211 |

||||

Bond issues |

7,445 |

4,177 |

1,021 |

||||

Derivatives |

480 |

674 |

75 |

||||

Loans with maturities of less than one year |

3,950 |

9,292 |

7,823 |

||||

Acquisition of Vinda, see Note F6 |

– |

– |

879 |

||||

BS Total 1) |

12,346 |

14,640 |

10,009 |

||||

|

|

|

|

||||

Non-current financial liabilities |

|

|

|

||||

Bond issues |

14,725 |

14,646 |

15,921 |

||||

Derivatives |

123 |

31 |

296 |

||||

Other long-term loans with maturities > 1 year < 5 years |

3,162 |

5,447 |

8,694 |

||||

Other long-term loans with maturities > 5 years |

3,465 |

4,122 |

2,160 |

||||

Acquisition of Vinda, see Note F6 |

– |

– |

1,632 |

||||

BS Total |

21,475 |

24,246 |

28,703 |

||||

Total financial liabilities |

33,821 |

38,886 |

38,712 |

||||

Fair value of financial liabilities |

33,877 |

39,243 |

36,500 2) |

||||

Borrowing

SCA has a Euro Medium Term Note (EMTN) program with a program amount of EUR 4,000m (SEK 36,522m) for issuing bonds in the European capital market. As of December 31, 2015, a nominal EUR 2,441m (2,043; 2,131) was outstanding with a remaining maturity of 4.1 years (3.4; 4.0).

Issued |

Maturity |

Carrying amount, SEKm |

Fair value, SEKm |

Notes SEK 1,800m |

2016 |

1,766 |

1,766 |

Floating Rate Note SEK 200m |

2016 |

200 |

200 |

Notes EUR 600m |

2016 |

5,478 |

5,478 |

Notes SEK 1,500m |

2018 |

1,510 |

1,498 |

Notes SEK 600m |

2019 |

604 |

592 |

Notes SEK 900m |

2019 |

944 |

902 |

Green bond SEK 1,500m |

2019 |

1,499 |

1,523 |

Notes EUR 300m |

2020 |

2,729 |

2,713 |

Notes EUR 500m |

2023 |

4,786 |

4,898 |

Notes EUR 300m |

2025 |

2,654 |

2,592 |

Total |

|

22,170 |

22,162 |

SCA has a Swedish and a Belgian commercial paper program that can be utilized for current borrowing.

Program size |

Issued SEKm |

||

|

|||

Commercial paper SEK 15,000m |

910 |

||

Commercial paper EUR 400m |

365 |

||

Total |

1,275 |

||

SCA has syndicated bank facilities to limit the refinancing risk and maintain a liquidity reserve. Contracted bilateral credit facilities with banks are used to supplement these syndicated bank facilities.

|

Nominal |

Maturity |

Total SEKm |

Utilized SEKm |

Unutilized SEKm |

Syndicated credit facilities |

EUR 1,000m |

2019 |

9,131 |

– |

9,131 |

|

EUR 1,000m |

2020 |

9,131 |

– |

9,131 |

Bilateral credit facilities |

SEK 322m |

2016 |

322 |

– |

322 |

Total |

|

|

18,584 |

– |

18,584 |

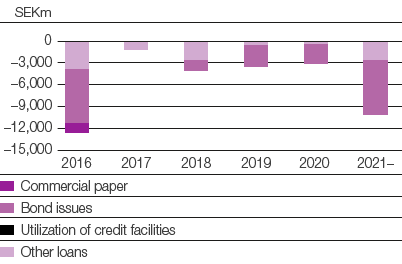

Maturity profile of gross debt

1) Gross debt includes accrued interest in the amount of SEK 105m.

After additions for net pension provisions and deductions for cash and cash equivalents, interest-bearing receivables and capital investment shares, net debt amounted to SEK 29,478m (35,947; 33,919). For a description of the methods used by SCA to manage its refinancing risk, refer to the Board of Directors’ Report.