The SCA share

SCA shares are quoted and traded on NASDAQ OMX Stockholm, and as American Depository Receipts (ADR level 1) in the US through Deutsche Bank. The final 2015 closing price on NASDAQ OMX Stockholm for SCA’s B share was SEK 246.50 (168.90), corresponding to a market capitalization of SEK 173bn (119) at December 31, 2015. In 2015, the price of SCA’s B share rose 46%, while the OMX Stockholm 30 Index declined 1% during the same period. The highest closing price for SCA’s B share during the year was SEK 256.80, which was noted on November 4. The lowest price was SEK 163.10 on January 7. The proposed dividend is SEK 5.75 (5.25) per share. For more information, refer to the section “Dividend and dividend policy” below.

Index

On NASDAQ OMX Stockholm, SCA is included in the OMX Stockholm 30 Index, OMX Nordic 40 and in the Personal & Household Goods sector within Consumer Goods. In addition to indexes directly linked to NASDAQ OMX Stockholm, SCA is included in other indexes, such as the FTSE Eurofirst 300 Index and FTSE Global Equity Index. Within MSCI, SCA is included in Household Products within Consumer Staples. SCA is also represented in sustainability indexes, including the Dow Jones Sustainability World Index, Dow Jones Sustainability Europe Index, FTSE4Good, OMX GES Sustainability Sweden PI and OMX GES Sustainability Nordic PI.

Liquidity

In 2015, the volume of SCA shares traded on NASDAQ OMX Stockholm was about 540 million (495), corresponding to a value of approximately SEK 119bn (88). Average daily trading for SCA on NASDAQ OMX Stockholm amounted to approximately 2.2 million shares, corresponding to a value of approximately SEK 474m (354). During the year, trading on BATS Chi-X amounted to approximately 228 million SCA shares, trading on Turquoise to about 55 million SCA shares and trading on other marketplaces to approximately 11 million SCA shares.

Ownership

Some 36% (39) of the share capital is owned by investors registered in Sweden and 64% (61) by foreign investors. The US and the UK account for the highest percentage of shareholders registered outside Sweden. Of SCA’s shareholders, at least 14% perform sustainability assessments.

Dividend and dividend policy

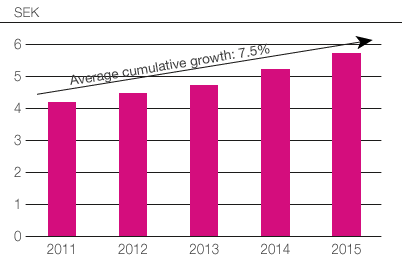

Dividend per share

SCA aims to provide long-term stable and rising dividends to its shareholders. When cash flow from current operations exceeds what the company can invest in profitable expansion over the long term – and under the condition that the capital structure target is met – the surplus shall be distributed to the shareholders. The Board of Directors proposes an increase the dividend by 9.5% to SEK 5.75 (5.25) per share for the 2015 fiscal year. Accordingly, dividend growth in the most recent five-year period amounted to 7.5%. The 2015 dividend represents a dividend yield of 2.3%, based on SCA’s share price at the end of the year.

Incentive program

SCA’s incentive program is designed to contribute to the creation of shareholder value. The program for senior executives consists of two components, one of which is tied to the total shareholder return on the SCA share compared with an index consisting of SCA’s largest global competitors. For more information about the structure of the program, see Note C3 (Remuneration of senior executives).