Economic value creation 2015

Sustainability forms an integral part of SCA’s business strategy and promotes the creation of economic value for employees, suppliers, society and shareholders.

Economic performance indicators

In 2015, SCA’s net sales totaled SEK 115,316m (104,054), a year-on-year increase of 11%. Personal Care grew by 11% and emerging markets accounted for 43% of sales. Net sales in Tissue rose 13% and emerging markets accounted for 32% of sales. Net sales in Forest Products rose 5%. Operating profit for the Group, excluding items affecting comparability, grew 10% to SEK 13,014m (11,849).

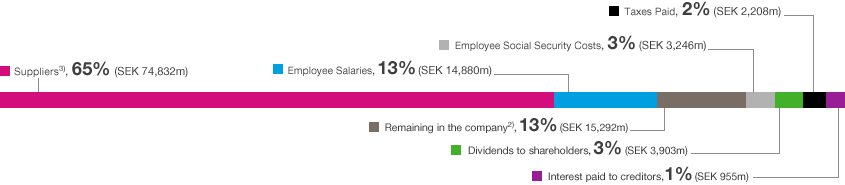

Economic value creation by stakeholder in 20151)

1) Based on SCA net sales in 2015.

2) Current expenditures, restructuring costs, strategic investments and acquisitions.

3) Raw materials, transport and distribution, energy and other cost of goods sold.

Employees

SCA offers its employees development opportunities and remuneration based on market rates. Remuneration comprises salary, pensions and other benefits.

SCA’s remuneration policy stipulates that the company is to offer competitive compensation. SCA follows local remuneration structures, provided they don’t conflict with internationally established rules for minimum wages and reasonable compensation. In all the reporting countries, SCA pays above the legislated minimum salaries. On average, entry salaries are 9% above minimum salaries. In France, Germany and Sweden (the wholly-owned subsidiaries with most employees) the average salary for women in relation to men is 101%, 94% and 96%, respectively. In 2015, salaries totaled SEK 14,880m (13,592), and social security costs, including pension costs, amounted to SEK 3,246m (2,929).

The Group’s pension costs totaled SEK 1,403m (1,179) and comprised costs for defined-benefit and defined-contribution pension plans. The defined-benefit plans are based on length of service and the employee’s salary on the date of retirement and, in 2015, the net cost was SEK 669m (541). The cost of defined-contribution plans amounted to SEK 734m (638). More information is available in Note C1 and Note C5 in SCA’s 2015 Annual Report.

When SCA acquires companies or enters into a joint venture in emerging markets, the company adopts an approach that involves great respect for the local management’s in-depth knowledge of the market and prevailing conditions. Accordingly, to the greatest possible extent, the management is retained while SCA adds knowledge about innovation, brands, technology and economies of scale. Local growth creates local jobs.

Suppliers

SCA strives to promote long-term relationships characterized by transparency, high quality and financial stability. We support our suppliers and work together with them to improve their overall performance in such areas as quality, safety, the environment and social responsibility.

Global commodities, such as pulp, superabsorbants, electricity and chemicals, are purchased centrally while other input goods, such as wood, are procured locally and thus contribute to local suppliers and local industry. Almost all of the fresh fiber purchased for the Swedish mills is locally sourced.

In 2015, the cost of purchased raw materials and services totaled SEK 74,832m (67,559), making sourcing SCA’s single largest cost item, corresponding to 65% (65) of sales and a key investment in the value chain.

Society

SCA creates job opportunities and tax revenues in the local economies where the Group operates. In 2015, the tax expense, excluding items affecting comparability, was SEK 3,306m (2,644). The reported tax expense corresponds to a tax rate of 27.4%. In addition, SCA’s total tax contribution includes social security costs, property taxes, energy and VAT. SCA assumes a long-term and responsible approach, voluntarily committing to promote and develop local communities through a number of community relations initiatives with a focus on health, hygiene and education, see chapter Community relations.

Our global tax principles

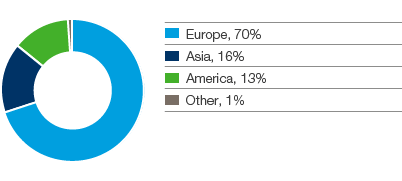

Tax paid by region 2015

SCA acts at all times in accordance with all applicable laws and is guided by relevant international standards such as OECD’s guidelines for multinational enterprises, the UN Global Compact and The United Nations Guiding Principles on Business and Human Rights (the UNGPs). We aim to comply with the spirit as well as the letter of the law, and to ensure that we pay the appropriate amount of tax in each country in which we operate. We do not use contrived or abnormal tax structures that are intended for tax avoidance, have no commercial substance or fail to meet the spirit of local or international law. Where states have weak or poorly constructed fiscal regulation and/or institutions, this should not be used to gain tax advantages that were not intended by the law. Secrecy jurisdictions or so-called tax havens are not used for tax avoidance.

We understand the value of our financial reporting to investors and society, and work to provide transparent and balanced disclosure in communicating our tax affairs.

SCA has systems in place to ensure compliance with the above principles. We provide relevant training for employees and offer them opportunities to raise concerns via SCA’s Complaint procedure.

The tables below show SCA’s total tax contribution by region and tax paid in different countries.

SEKm |

|

|

|

Country |

2015 |

2014 |

2013 |

Germany |

–358 |

–271 |

–179 |

France |

–306 |

–264 |

–116 |

China |

–236 |

–51 |

–2 |

Mexico |

–121 |

–107 |

–37 |

UK |

–115 |

–92 |

–20 |

Austria |

–100 |

–60 |

–96 |

Spain |

–90 |

–90 |

–80 |

Italy |

–87 |

–77 |

–82 |

Belgium |

–80 |

–91 |

–92 |

Sweden |

–79 |

–65 |

–99 |

Other countries |

–636 |

–933 |

–938 |

|

–2,208 |

–2,101 |

–1,741 |

Shareholders

Sustainability, with an emphasis on business value, is part of SCA’s investor dialog. In 2015, SCA met with SRIs (Socially Responsible Investors) on several occasions, and participated in SRI investor conferences in Paris and Frankfurt.

Investors with sustainability criteria hold at least 14% (14) of SCA’s shares, according to a study conducted by the ESG (environment, social, governance) rating company Vigeo. This figure includes both investors with a best-in-class approach and investors who conduct some form of sustainability screening. In 2015, Vigeo conducted a benchmark study in which SCA was compared with two key peer consumer products companies and one Swedish large-cap company recognized as a sustainability leader. SCA had a significantly higher share of investors with sustainability criteria than its peers and on par with the sustainability leader. SCA’s share was included in 131 (128) sustainability funds in 2015. Most of these are domiciled in the Netherlands, followed by Sweden, the United States and Germany. Of these, 39 had invested more than 3% of their assets in SCA shares.

Share performance

SCA generates shareholder value through dividends and share price appreciation. SCA aims to provide long-term stable and rising dividends to its shareholders. When cash flow from current operations exceeds what the company can invest in profitable expansion over the long term – and under the condition that the capital structure target is met – the surplus shall be distributed to the shareholders.

The Board has proposed a dividend of SEK 5.75 (5.25) for 2015, an increase of 9.5%. Over the past five-year period, the dividend has increased by an average of 7.5% annually.

During the year, the SCA share price rose by 46% to a closing price of SEK 246.50. In comparison, the OMX Stockholm 30 Index declined by 1%.

At year-end 2015, SCA had 77,184 registered shareholders.

Indexes and funds

- The Dow Jones Sustainability World Index and the Dow Jones Sustainability Europe Index. SCA was also named industry leader in the Household Products sector.

- The Ethisphere Institute’s list of the world’s most ethical companies.

- The FTSE4Good index series, which measures earnings and performance among companies that meet globally recognized norms for corporate responsibility. SCA has been included in the index since 2001 and was awarded the highest rating in its industry.

- The Climate Disclosure Leadership Index (CDLI), which recognizes companies with the most transparent carbon reporting practices and that show proven ability to tackle climate change. SCA achieved the highest score possible: 100.

- SCA was recognized by the WWF for leadership in transparency for disclosing its ecological footprint in the WWF Environmental Paper Index 2015. SCA improved its scores in all categories compared with the latest survey in 2013.

- Vigeo assesses companies’ environmental, social and governance (ESG) performance. SCA is included in the following sustainability funds of Vigeo: Ethibel Sustainability Excellence Europe and Ethibel Sustainability Excellence Global.

- EPCI Euro Ethical Equity and EPCI Global Ethical Equity.

- The OMX GES Sustainability Nordic and OMX GES Sustainability Sweden.