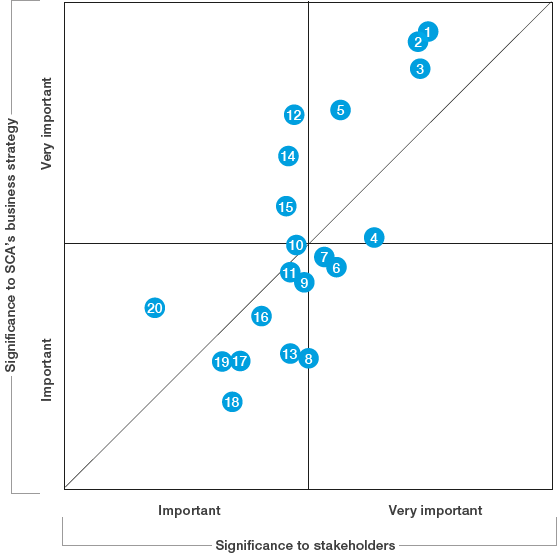

SCA’s materiality analysis

The materiality analysis provides insight into the issues that are significant to SCA’s stakeholders and forms the basis of the company’s strategy and operations.

SCA conducts a materiality analysis biennially, with the most recent conducted in 2015. A total of 1,100 customers, consumers, suppliers, investors, representatives of the media and stakeholder organizations as well as SCA employees participated in the online survey that formed the basis of the materiality analysis.

SCA previously conducted materiality analyses in 2008, 2010, 2012 and 2013. While the analyses performed between 2008 and 2012 were focused on sustainability, the 2013 and 2015 analyses took a broader approach. Stakeholder opinions are highly significant to SCA’s strategic priorities, which is why the scope has been broadened beyond environmental and social aspects, and now encompasses the entire operation. The results are also included in chapter Our Crossroads of the Annual Report.

The selection of subject areas to be included in the materiality analysis was guided by such governing documents as the Global Reporting Initiative, the UN Global Compact, SCA’s Code of Conduct and on the basis of SCA’s own assessment. The 2015 survey included 20 topics and all selected areas are material for SCA. Two topics – transparency and digital excellence – were new in this year’s survey. Transparency is defined as open communication and accountability, and digital excellence as digital strategy and related activities to maximize business benefit. Financial risks was replaced with risk management. The respondents were able to select the ten areas they considered to be most important from the list of 20. The stakeholders’ order of priority of the areas was combined with SCA’s own assessment of how important the areas are to the company’s business strategy and were placed in the materiality analysis as coordinates. The stakeholder groups’ results were weighted to provide a balanced view of the results. SCA’s own assessment was based on the evaluation of the top 150 senior executives.

There is a high degree of consensus between the views of stakeholders and those of SCA in terms of the material areas, with innovation, customer satisfaction and business ethics receiving a clear top ranking. The group that deviates somewhat comprises investors and analysts, who instead rank corporate governance in second place, while customer and consumer satisfaction is ranked fifth. The results of the survey appear to be reasonable and relevant and provide us with a basis for our strategy and operations, and for the content of the Annual Report and Sustainability Report.

The factors considered most material to SCA’s stakeholders

1 Innovation

2 Customer and consumer satisfaction

3 Business ethics

4 Transparency

5 Health and Safety

6 Human rights

7 Resource efficiency

8 Forest assets

9 Corporate governance

10 Product safety

11 Supply chain efficiency

12 Human capital

13 Carbon emissions

14 Brands

15 Market positions

16 Risk management

17 Water use and water purification

18 Distribution

19 Post-consumer waste

20 Digital excellence

The materiality analysis is a tool used to understand the issues that are most important and relevant to SCA. The horizontal axis shows the degree of importance stakeholders attach to the various topics, while the vertical axis represents SCA’s assessment of how important the topics are to our business strategy and operations. In most cases, the assessments of stakeholders and SCA coincide.

1. Innovation is ranked number one by stakeholders and SCA, which confirms the relevance of the choice of innovation as one of SCA’s strategic priorities. The aspect of sustainability is integrated in the innovation process, and we launched some 30 innovations in 2015.

2. Customer and consumer satisfaction is assessed as the most important area by SCA’s customers and consumers and as the second most important by other stakeholders. We conduct regular customer and consumer surveys and feed back opinions and complaints to the business as a basis for improvements.

4. Transparency is a new topic in this year’s survey, and stakeholders value transparency higher than SCA. This may be because SCA already considers itself to be a transparent company, but could also be because stakeholders include product safety in transparency. Product safety fell from fourth to tenth place in this year’s survey.

8. Forest assets are assigned greater importance by stakeholders than by SCA. One explanation for this may be that stakeholders see the forest from a global deforestation perspective, while we refer to our own, sustainably managed forest assets in Sweden.

12. Human capital is assigned less importance by stakeholders than by SCA. It appears reasonable that we have greater insight into how crucial employee attitudes and expertise are to the Group’s success. Our All Employee Survey provides valuable knowledge about employee opinions and constitutes a tool for improvement activities.

13. Stakeholders assign greater importance to CO2 emissions than SCA does. This may be because climate change is a global issue and involves the survival of our planet, while SCA views CO2 from a corporate perspective. SCA has established ambitious CO2 targets and owns a forest holding that net absorbs 2.6 million tons of CO2.