Market

In 2016, net sales in the Forest Products business area amounted to approximately SEK 17bn. At the end of 2016, SCA conducted manufacturing activities at 18 sites.

SCA forest products’ production is concentrated to Northern Sweden in close proximity to its forest holdings, which enables efficient utilization throughout the value chain from young forest plants via harvestable wood to value-added products.

SCA is one of Europe’s largest suppliers of forest-based biofuels where tree branches, crowns, stumps, bark, sawdust and peat are refined into pellets, briquettes or are incinerated directly in the company’s own or external heating plants or cogeneration plants.

In 2016, SCA used biofuel equivalent to almost 8 TWh in its own operations and approximately 1 TWh was sold externally. Use in the Group’s own operations has increased substantially in recent years as fossil oil in pulp production has been replaced with pellets. In addition, SCA produces and sells district heating externally, equivalent to 0.4 TWh annually. SCA’s strategy in terms of wind power is based on making suitable forest land available for leasing or partnership. Some areas of forest land owned by SCA have very good wind conditions and at the end of 2016, 320 wind turbines were in operation or under construction on SCA’s land, with an average annual production of about 2.5 TWh. The ambition is that wind power production on SCA’s forest land shall increase to 5 TWh by 2020.

Forest

Profitable forest management primarily comprises regular harvesting operations, increase in value through biological growth of the forest, and future price increases of forest land. Examples of other large Swedish forest owners are Bergvik Skog, Holmen and Sveaskog.

Solid-wood products

The main demand for wood products is from the construction and house building industry, with 85% of wood products being used in the construction sector. The construction industry in the Nordic region is in a strong expansion phase, through substantial demand for new building, remodeling and extensions. This benefits sawmills and contributes to a healthy demand in the market for wood products. A significant part of SCA’s solid-wood products are sold through SCA’s sales offices. The remaining part is sold by third-party agents and by SCA’s own wholesalers. Customers in solid-wood products are mainly the construction, processing and building merchants industries. SCA’s competitors within solid-wood products include, for example, Holmen, Moelven, Setra, Stora Enso, Södra and Vida.

European demand for solid-wood products increased in 2016.

Pulp

Within pulp, SCA mainly conducts operations within bleached softwood kraft pulp “NBSK”, characterized by high strength and purity. The market development has benefitted from growth in both the hygiene and packaging segments and that decreasing demand for graphic paper which has reduced the amount of white recovered fiber1) in circulation. Some paper manufacturers therefore increasingly use fresh fiber. The price of pulp is influenced by changes in inventory, capacity utilization and market expectations among buyers and sellers. Typical end-products in the NBSK range are graphic paper, tissue and white packaging. SCA’s competitors within NBSK pulp production include, for example, Mercer International, Metsä Fiber, Stora Enso, Södra and UPM. Pulp products are mainly sold directly from the mill’s sales organization and distributed through SCA’s logistics system to business customers.

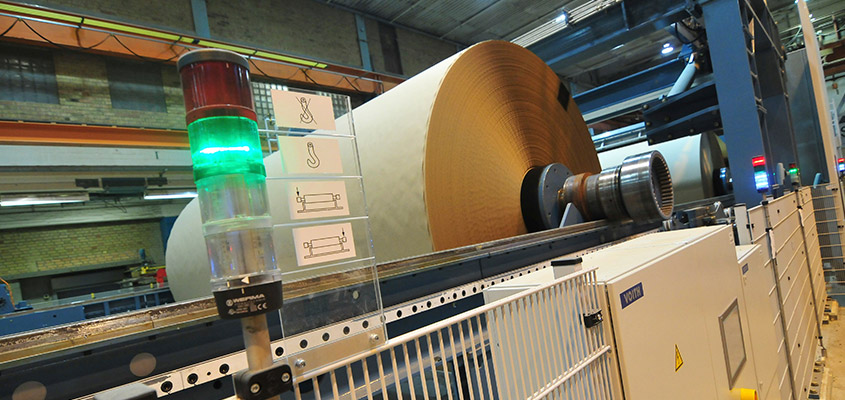

Paper

Globalization, increasing trade volumes, digitalization and higher standards of living are driving demand for packaging solutions, while environmental awareness favors renewable materials, such as paper products and board. Customers within kraftliner, packaging paper based on fresh wood fiber, include corrugated board producers and other packaging manufacturers. Paper products are, in key markets, sold by SCA’s sales offices to business customers. Publication paper end-markets are mainly magazines, catalogues and advertising material. SCA’s competitors within publication papers include, for example, Holmen, Stora Enso and UPM and for kraftliner International Paper, Mondi, Smurfit Kappa and Stora Enso.

European demand for kraftliner increased in 2016. European demand for publication papers continued to decrease in 2016.

1) White recovered fiber can be used in the production of certain paper qualities but must be supplemented with fresh fiber. The reduction in demand for graphic paper has resulted in a drop in the availability of white recovered fiber, which means demand for fresh fiber has increased.