D7. Other provisions

AP ACCOUNTING PRINCIPLES

Provisions are recognized in the consolidated balance sheet when there is a legal or informal obligation arising from events that have occurred and it is probable that payments will be required to settle the obligation. It must also be possible to reliably estimate the amount to be paid. The provision is valued at the present value of the anticipated future expenditure to settle the obligation.

A provision for restructuring measures is recognized when the Group has established a detailed plan and either implementation has begun or the main features of the measures have been communicated to the parties involved. Restructuring costs include, for example, costs for plant closures, impairment of production machinery and costs for personnel reductions.

KAA KEY ASSESSMENTS AND ASSUMPTIONS

The amount of the provisions made relating to national competition investigations is based on the company’s best assessment, which was determined in consultation with local expertise in the field. Considering the tax risks it is also based on SCA’s best assessment, which in most cases is determined in consultation with local expertise.

SEKm |

Efficiency programs |

Tax risks |

Environment |

Legal disputes |

Other |

Total |

Value, January 1 |

581 |

784 |

92 |

48 |

386 |

1,891 |

Provisions |

738 |

91 |

76 |

1,173 |

95 |

2,173 |

Utilization |

–402 |

–358 |

–72 |

–312 |

–41 |

–1,185 |

Reclassifications |

– |

– |

–14 |

96 |

–67 |

15 |

Dissolutions |

–28 |

– |

–2 |

–2 |

–40 |

–72 |

Translation differences |

28 |

3 |

–2 |

6 |

3 |

38 |

Value, December 31 |

917 |

520 |

78 |

1,009 |

336 |

2,860 |

|

|

|

|

|

|

|

Provisions comprise: |

|

|

|

|

|

|

BS Short-term component |

|

|

|

|

|

1,447 |

BS Long-term component |

|

|

|

|

|

1,413 |

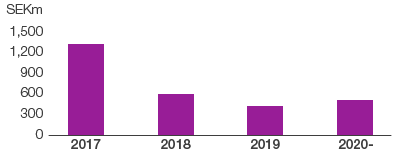

Distribution of other provisions by maturity

Of the provisions for the period for “Environment,” SEK 75m pertains to a liability for carbon dioxide emissions, which will be paid out in 2017. Of the “Efficiency programs” provisions, SEK 402m was paid out in 2016. The provisions for efficiency programs consist of personnel costs and closure costs in connection with restructuring. Tax risks mainly comprise one tax dispute attributable to Denmark. Legal disputes mainly consist of reserves relating to competition cases, primarily attributable to Poland, Chile, Hungary and Spain. During the year, provisions and payments were also made relating to a competition case in Colombia. The provisions for legal disputes were impacted by reclassification between the categories. Other provisions mainly comprise reserves in connection with prior divestments of operations, a reserve for final settlement of a prior investment and a reserve for potential packaging costs.