The year at a glance

GROUP 2016

Net sales

SEKm

117,314

(115,316)

Increased 2% compared with 2015.

Earnings per share

SEK

7.93

(9.97)

Organic sales

%

+2%

(+5%)

Excludes exchange rate effects, acquisitions and divestments.

Adjusted return on capital employed1)

%

12.5%

(12.0%)

Adjusted operating profit1)

SEKm

13,989

(13,014)

Increased 7% compared with 2015 (8% excluding currency translation effects, acquisitions and divestments).

Adjusted return on equity1)

%

11.0%

(11.6%)

Adjusted operating margin1)

%

11.9%

(11.3%)

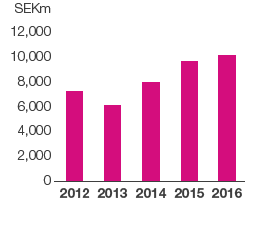

Cash flow from current operations

SEKm

10,382

(9,890)

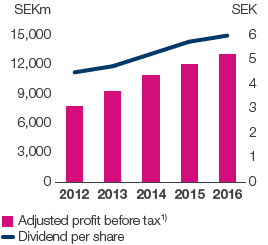

Adjusted profit before tax1)

SEKm

13,070

(12,059)

Increased 8% compared with 2015.

Proposed dividend per share

SEK

6.00

(5.75)

|

|

2016 |

|

2015 |

||||||||||||

|

|

SEK |

|

EUR 2) |

|

SEK |

|

EUR 2) |

||||||||

|

|||||||||||||||

|

Net sales, SEKm/EURm |

117,314 |

|

12,406 |

|

115,316 |

|

12,334 |

||||||||

|

Operating profit, SEKm/EURm |

11,279 |

|

1,193 |

|

10,947 4) |

|

1,171 4) |

||||||||

|

Adjusted operating profit SEKm/EURm 1) |

13,989 |

|

1,480 |

|

13,014 |

|

1,392 |

||||||||

|

Operating margin, % |

9.6 |

|

|

|

8.7 |

|

|

||||||||

|

Adjusted operating margin, % 1) |

11.9 |

|

|

|

11.3 |

|

|

||||||||

|

Profit before tax, SEKm/EURm |

10,360 |

|

1,096 |

|

9,992 |

|

1,069 |

||||||||

|

Adjusted profit before tax, SEKm/EURm 1) |

13,070 |

|

1,383 |

|

12,059 |

|

1,290 |

||||||||

|

Profit for the year, SEKm/EURm |

6,012 |

|

636 |

|

7,452 |

|

797 |

||||||||

|

Adjusted profit for the year, SEKm/EURm 1) |

8,295 |

|

877 |

|

8,753 |

|

936 |

||||||||

|

Earnings per share, SEK |

7.93 |

|

|

|

9.97 |

|

|

||||||||

|

Adjusted earnings per share, SEK 1) |

11.18 |

|

|

|

11.82 |

|

|

||||||||

|

Cash flow from current operations per share, SEK |

14.78 |

|

|

|

14.08 |

|

|

||||||||

|

Equity per share, SEK |

112.78 |

|

|

|

107.35 |

|

|

||||||||

|

Dividend per share, SEK |

6.00 3) |

|

|

|

5.75 |

|

|

||||||||

|

Strategic capital expenditures, including acquisitions, SEKm/EURm |

–10,862 |

|

–1,149 |

|

–3,218 |

|

–344 |

||||||||

|

Divestments, SEKm/EURm |

489 |

|

52 |

|

329 |

|

35 |

||||||||

|

Equity, SEKm/EURm |

79,519 |

|

8,319 |

|

75,691 |

|

8,290 |

||||||||

|

Return on capital employed, % |

10.1 |

|

|

|

10.1 |

|

|

||||||||

|

Adjusted return on capital employed, % 1) |

12.5 |

|

|

|

12.0 |

|

|

||||||||

|

Return on equity, % |

7.9 |

|

|

|

9.9 |

|

|

||||||||

|

Adjusted return on equity, % 1) |

11.0 |

|

|

|

11.6 |

|

|

||||||||

|

Debt/equity ratio |

0.44 |

|

|

|

0.39 |

|

|

||||||||

|

Debt/equity ratio, excluding pension liabilities |

0.39 |

|

|

|

0.36 |

|

|

||||||||

|

Average number of employees |

46,171 |

|

|

|

44,000 |

|

|

||||||||

|

No. of employees at Dec. 31 |

46,429 |

|

|

|

44,051 |

|

|

||||||||

KEY EVENTS IN 2016:

- Initiated work in order to be able to propose to the 2017 Annual General Meeting to decide on a split of the SCA Group into two listed companies: hygiene and forest products.

- Entered into an agreement to acquire BSN medical, a leading medical solutions company, which develops, manufactures, markets and sells products within wound care, compression therapy and orthopedics. The purchase price for the shares amounts to EUR 1,400m and takeover of net debt to approximately EUR 1,340m5). The completion of the transaction is subject to customary regulatory approvals and closing is expected to take place during the second quarter 2017.

- The acquisition of Wausau Paper Corp., a leading North American AfH tissue company, was completed. Following the acquisition, SCA is the second largest player in the AfH tissue segment in the North American market.

- The divestment of the hygiene business in Southeast Asia, Taiwan and South Korea for integration with Vinda was closed. SCA is the majority shareholder in Vinda, one of China’s largest hygiene companies.

- A new production facility for incontinence products in Brazil was inaugurated.

- Decision was taken on restructuring measures in tissue production in France and Spain.

- The baby diaper business in Mexico was closed as part of the work to address weak market positions with inadequate profitability.

- Decision was taken to discontinue the hygiene business in India as a result of SCA’s conclusion that profitability cannot be achieved within a reasonable time frame. Discontinuation of the hygiene business will take place in the first quarter of 2017.

- Launch of the “Hygiene Matters 2016–2017” report together with the UN Water Supply and Sanitation Collaborative Council (WSSCC). The report focuses on taboos and stigma surrounding incontinence and menstruation and has a close link to the UN’s Sustainable Development Goals.

- Recognized by CDP, an international non-profit organization that works to promote sustainable economies, as a global leader for its strategies and actions in response to climate change. SCA was also awarded a position on the Climate A List by CDP.

5) Estimated as of December 31, 2016.

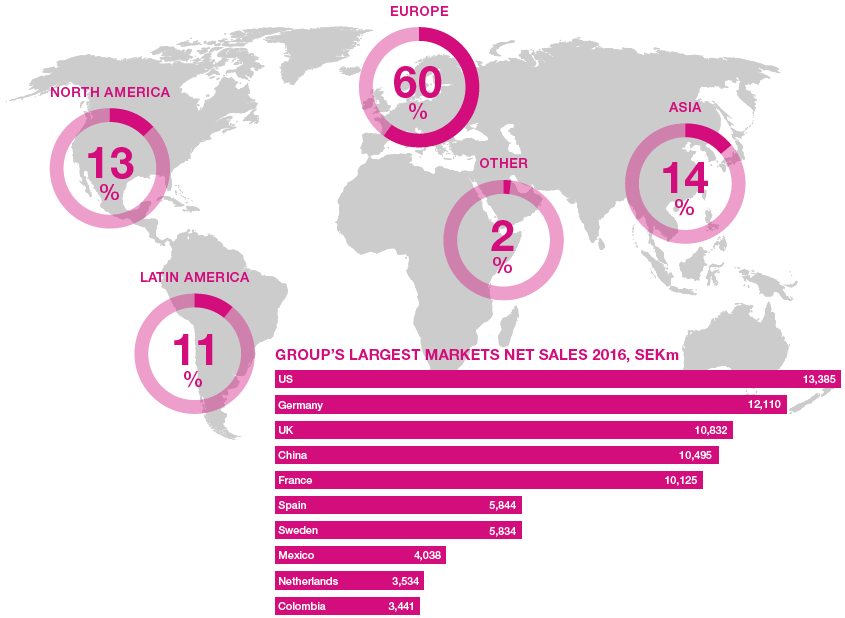

NET SALES BY REGION 2016

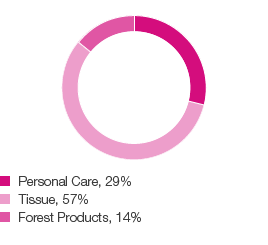

Net sales 2016

(share of Group)

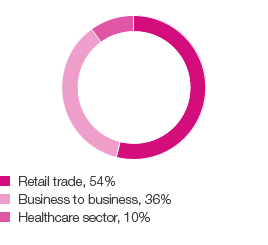

Net sales by distribution channel 2016 (share of Group)

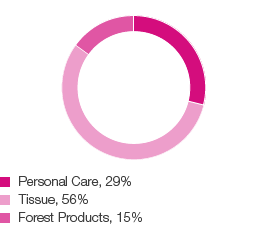

Adjusted operating profit1) 2016

(share of Group)

1) Excluding items affecting comparability.

Net sales and

adjusted operating margin1)

1) Excluding items affecting comparability.

2012 and 2013 restated in accordance with IFRS 10 and 11.

Adjusted profit before tax1)

and dividend per share

1) Excluding items affecting comparability.

2012 and 2013 restated in accordance with IFRS 10 and 11.

Cash flow from current operations

2012 and 2013 restated in accordance with IFRS 10 and 11.

INITIATED WORK IN ORDER TO BE ABLE TO PROPOSE TO THE 2017 ANNUAL GENERAL MEETING TO DECIDE ON A SPLIT OF THE SCA GROUP INTO TWO LISTED COMPANIES: HYGIENE AND FOREST PRODUCTS

On August 24, 2016, SCA announced that the company would initiate work in order to be able to propose to the 2017 Annual General Meeting to decide on a split of the SCA Group into two listed companies; one for the hygiene business and one for the forest products business. A split of the Group and a distribution and listing of shares in the subsidiary which today operates the hygiene business, is expected to increase focus, customer value, development opportunities and enables each company to successfully realize its strategies under the leadership of separate and dedicated management teams, two different boards of directors and independent access to capital. This is considered to increase value for SCA’s shareholders in the long term. In addition, the synergies between the operations have diminished over time and are currently limited. An evaluation of various methods and structural alternatives to carry out a complete split of the business into two separate companies has been carried out. Therefore, the Board of Directors has proposed to the 2017 AGM a distribution of all shares in and listing of the company’s hygiene business. Distribution to shareholders is proposed in proportion to their holdings of Class A and Class B shares. If shareholders approve the proposal, the new hygiene company is planned to be distributed and listed on Nasdaq Stockholm no later than the second half of 2017.

SCA TO ACQUIRE BSN MEDICAL, A LEADING MEDICAL SOLUTIONS COMPANY

On December 19, 2016, SCA announced that it had entered into an agreement to acquire BSN medical, a leading medical solutions company. BSN medical develops, manufactures, markets and sells products within wound care, compression therapy and orthopedics. The purchase price for the shares amounts to EUR 1,400m and takeover of net debt to approximately EUR 1,340m1). The completion of the transaction is subject to customary regulatory approvals. Closing of the transaction is expected to take place during the second quarter of 2017.

BSN medical is an innovative medical solutions company with well-known brands such as Leukoplast, Cutimed, JOBST, Delta Cast, Delta Lite and Actimove. The company has a sales organization with sales in more than 140 countries and production in 11 countries as well as approximately 6,000 employees.

The BSN medical acquisition is an excellent strategic fit for SCA and supports the company’s vision to improve well-being through leading hygiene and health solutions, two closely interlinked areas. BSN medical has leading market positions in several attractive medical product categories and provides a new growth platform with future industry consolidation opportunities. SCA’s incontinence business, with the globally leading TENA brand, shares similar positive market characteristics, customers and sales channels with BSN medical, which will provide opportunities for accelerated growth through cross-selling.

BSN medical reported net sales for 2015 of EUR 861m (SEK 8,050m), adjusted EBITDA2) of EUR 201m (SEK 1,879m), an adjusted operating profit3) of EUR 137m (SEK 1,281m), an adjusted operating margin3) of 15.9%, and an adjusted return on capital employed3) of 7.7%. BSN medical reported net sales of EUR 627m (SEK 5,872m) for the first nine months of 2016, adjusted EBITDA2) of EUR 151m (SEK 1,414m), an adjusted operating profit3) of EUR 103m (SEK 965m), and an adjusted operating margin3) of 16.4%.

The acquisition is expected to be accretive to SCA’s earnings per share from the first year. BSN medical has high cash conversion and an asset-light business model.

In relation to the acquisition, SCA expects to realize annual synergies of at least EUR 30m with full effect three years after closing. Restructuring costs are expected to amount to approximately EUR 10m and are expected to be incurred in the first three years following completion.

Transaction costs amount to approximately EUR 25m, of which approximately EUR 15m has been recognized as an item affecting comparability in the fourth quarter of 2016. The remaining costs will be recognized as an item affecting comparability in the second quarter of 2017. Intangibles related to the acquisition are expected to amount to approximately EUR 2.7bn. The acquisition will be fully debt funded and SCA has committed credit facilities in place. SCA remains fully committed to retaining a solid investment grade rating.

1) Estimated as of December 31, 2016.

2) Excluding items affecting comparability.

3) Excluding items affecting comparability and including BSN medical’s purchase price allocation amortization.

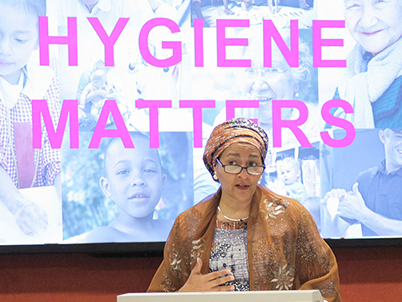

Hygiene concerns us all

Amina Mohammed, Deputy Secretary-General of the UN and chair of the WSSCC, was one of the keynote speakers when the Hygiene Matters report was launched in New York in September 2016.

Poor hygiene and sanitation constitute a barrier to the health, well-being, livelihood and development of millions of people. SCA has gathered insights and ignited the conversation around the role and importance of hygiene over a period of many years and via its Hygiene Matters initiative since 2008. Through the Hygiene Matters initiative, SCA wants to increase awareness of the importance of hygiene and its link to health and well-being and break the taboos surrounding issues such as menstruation and hygiene.

SCA is contributing to raise hygiene standards worldwide through its business model and hygiene solutions. Two integral aspects of the Hygiene Matters initiative are a global consumer survey and the Hygiene Matters report. The 2016/2017 report looked at the economic value of investing in hygiene, breaking taboos and stigma surrounding menstruation and incontinence, as well as innovative solutions for the future. For the first time, the report was produced in collaboration with the Water Supply and Sanitation Collaborative Council (WSSCC). The WSSCC is the only UN body that works solely with sanitation and hygiene issues.

In September 2016, SCA launched together with the UN body WSSCC the “Hygiene Matters 2016–2017” report.

The report was launched in conjunction with the UN General Assembly Session in New York at the end of September 2016. The main speaker was Amina Mohammed, chair of the WSSCC and Deputy Secretary-General of the UN, and Med. Dr. Sci. Ewa Björling, former trade minister in Sweden and member of the SCA Board. An interesting debate was held with leading representatives from the UN Sustainable Development Solutions Network and CEO Water Mandate, among others.

In October 2016, companies, authorities and NGOs gathered in New York to take part in the UN Foundation’s dialog about the UN’s global agenda for sustainable development. The UN Foundation acts as a link to the UN. The organization gathers the business community and civil society to help the UN tackle some of the world’s most pressing issues, one of which is global health.

SCA’s representatives at the meeting included President and CEO Magnus Groth, who also gave the opening speech. He spoke of the link between hygiene, health and well-being and emphasized that the business community has an important role to play in this context. He also highlighted that cooperation between the public and private sector is vital if the world is to succeed in reaching the UN’s Sustainable Development Goals.

Several panel debates during the dialog meeting also discussed cooperation between sectors as a way to inspire decision-makers to move the world forward. SCA contributes through its considerable commitment to hygiene and health, and by sharing its insights with others.

SCA had also invited a number of customers and business partners to discuss how they can work to support the UN’s Sustainable Development Goals and how the UN’s goals will influence the business sector. This, in itself, can support customers and SCA’s business partners in their work with sustainability.

The importance of hygiene

Every day, about 500 million people rely on SCA’s hygiene products to live a healthy life. Since October 2016, SCA’s President and CEO, Magnus Groth, has regularly contributed with editorials to the Huffington Post, as a HuffPo writer. His articles are about the importance of hygiene and highlight the link between hygiene, health and well-being.