Market

The global market for personal care products is valued at slightly more than SEK 400bn and is growing at a rate of some 5% annually. Incontinence products is the Personal Care segment that has the highest rate of growth. Institutional care and homecare account for about 55% of the global market for incontinence products and the retail market accounts for approximately 45%.

In 2015, the European and North American markets for incontinence products showed low growth in the institutional and homecare sectors and favorable growth in the retail market compared with the preceding year. Emerging markets showed favorable growth in demand for incontinence products. The global market for incontinence products was affected by greater competition and campaign activity. In Europe, demand for baby diapers was stable, while demand for feminine care products decreased slightly. In emerging markets, demand grew for baby diapers and feminine care products. The global market for baby diapers was characterized by intense competition and campaign activity.

Shifts in global demographics such as population growth – due primarily to a lower infant mortality rate and increased longevity – and higher disposable incomes point to continued good growth for personal care products. The effect of higher disposable incomes is that more people prioritize hygiene when food and housing needs have been, or are in the process of being, satisfied. Consequently, demand for personal care products is rising in emerging markets. The growth potential for personal care products is greatest in emerging markets where market penetration is significantly lower than in mature markets and where urbanization, improved infrastructure and the retail trade are evolving rapidly. One example of the lower market penetration in emerging markets is that the consumption rates for baby diapers and incontinence products per capita and year in Asia are only about one-fifth and one-seventh, respectively, of those in Western Europe. In mature markets, baby diapers and feminine care products have attained high market penetration, while market penetration for incontinence products in mature markets remains relatively low, particularly among men.

Incontinence, which is classed as a disease by the World Health Organization (WHO), affects 4–8% of the world’s population, corresponding to approximately 400 million people. Many indicators point to the proportion of people affected increasing on a global scale as a result of an aging population. By 2020, the population of the world over the age of 60 is expected to have increased by 15% and pass the one billion mark. The occurrence of incontinence among people over the age of 65 is expected to be between 15 and 20%.

SCA’s competitors in personal care include Kimberly-Clark, Procter & Gamble and Unicharm.

Brands in Personal Care

|

Europe |

North America |

Global |

||

|

|||||

Incontinence products |

1 |

4 |

1 |

||

Baby diapers |

2 |

– |

4 |

||

Feminine care |

3 |

– |

5 |

||

|

|

|

|

||

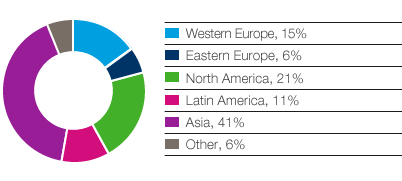

Personal care products – global market